Zakat Calculator

Zakat: Meaning, Importance, Nisab, Zakat Calculator, and Complete Islamic Guide

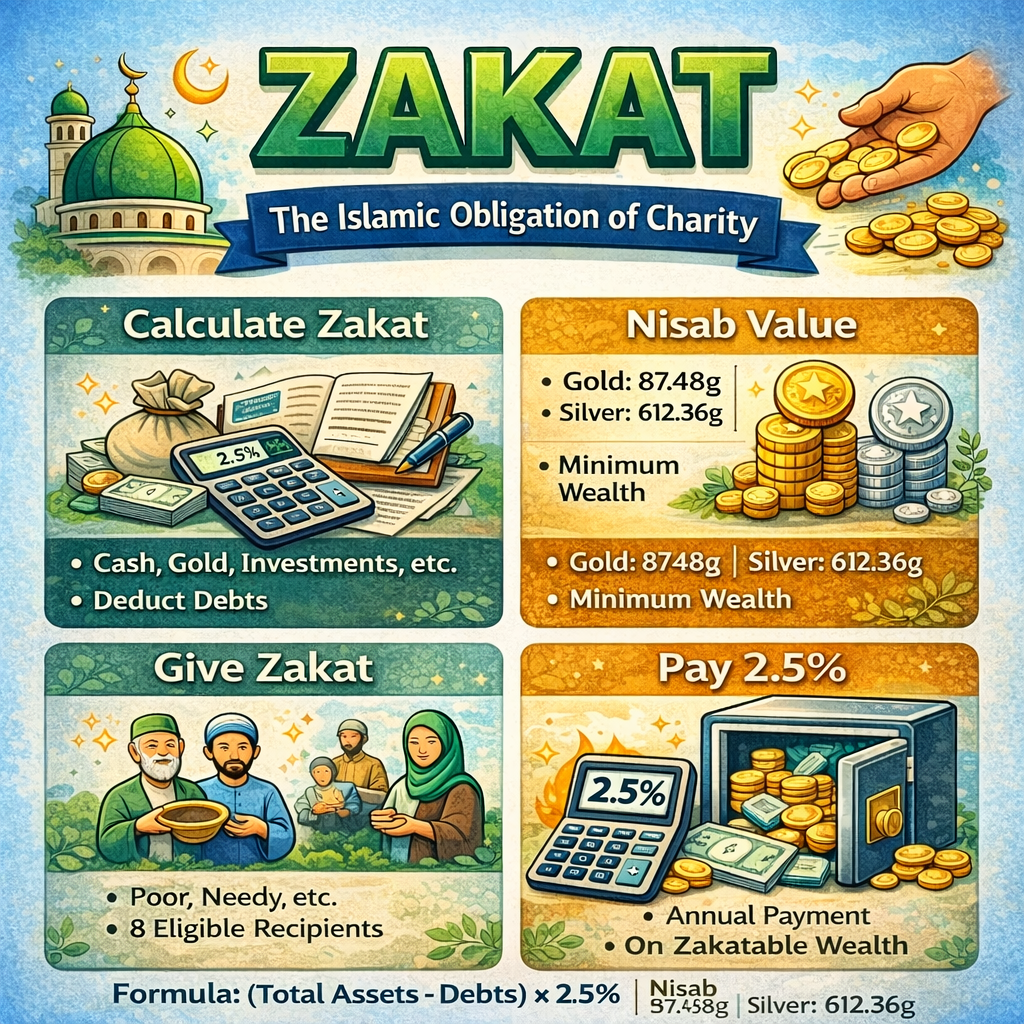

Zakat is one of the five pillars of Islam and a fundamental act of worship that purifies wealth and supports social justice. It is not merely charity but an obligatory duty upon eligible Muslims. Understanding Zakat correctly is essential to fulfill this obligation according to Islamic teachings.

This article explains everything about Zakat—its meaning, Islamic perspective, Nisab, calculation method, assets included, who must pay, who can receive it, and common questions.

What Is Zakat?

The word Zakat comes from the Arabic root “zakā”, meaning purification, growth, and blessing. In Islam, Zakat refers to a fixed portion of wealth that Muslims must give annually to those entitled to receive it.

Definition (Islamic)

Zakat is a compulsory annual payment of 2.5% on eligible wealth, given to specific categories of people, once the wealth reaches the Nisab and is held for one lunar year (Hawl).

Importance of Zakat in Islam

Zakat holds immense importance in Islam and is mentioned alongside Salah in the Qur’an multiple times.

Qur’anic Evidence

“And establish prayer and give Zakat…”

— Surah Al-Baqarah (2:43)

Hadith

The Prophet Muhammad ﷺ said:

“Islam is built upon five pillars… to give Zakat.”

— Sahih Bukhari

Why Zakat Is Important

- Purifies wealth and soul from greed

- Reduces poverty and inequality

- Strengthens community bonds

- Brings barakah (blessing) in wealth

- A test of obedience to Allah

Who Must Pay Zakat?

Zakat is obligatory on a Muslim who meets the following conditions:

Must be Muslim

Must be adult and sane

Must own wealth above the Nisab

Wealth must be fully owned

Wealth must be held for one lunar year (Hawl)

What Is Nisab?

Nisab is the minimum amount of wealth a Muslim must own before Zakat becomes obligatory.

Nisab of zakat

Zakat Nisab is determined using gold or silver values:

| Metal | Weight | Basis |

| Gold | 87.48 grams | Higher threshold |

| Silver | 612.36 grams | Lower threshold |

Most scholars recommend using silver Nisab today, as it benefits the poor by making more people eligible to pay Zakat.

Types of Wealth on Which Zakat Is Due

Zakat is paid on specific types of assets, not on everything a person owns.

1.Cash & Savings

Cash at home

Bank balances

Savings accounts

2. Zakat on Gold & Silver

Jewelry (according to most scholars)

Coins, bars

Stored gold/silver

3. Business Assets

Inventory for sale

Business cash

Trade goods

4. Investments

Stocks (trade value)

Mutual funds

Investment accounts

5. Loans Given

Money you expect to receive back

Assets Exempt from Zakat

- Personal residence

- Clothes for daily use

- Household items

- Personal car

- Tools used for work

Liabilities & Debts Deduction

Before calculating Zakat, you can deduct:

Immediate debts

Outstanding bills

Short-term loans payable

how to calculate zakat ?

Standard Formula

Zakat = (Total Zakatable Assets − Liabilities) × 2.5%

Zakat Rate

The standard Zakat rate is:

✅ 2.5% (1/40th) per lunar year

This applies to cash, gold, silver, business assets, and investments.

Who Can Receive Zakat? (Asnaf)

Allah clearly defines Zakat recipients in the Qur’an:

“Zakat is only for the poor, the needy…”

— Surah At-Tawbah (9:60)

8 Categories of Zakat Recipients

Poor (Al-Fuqara)

Needy (Al-Masakin)

Zakat administrators

New Muslims

Freeing slaves

Debtors

In the cause of Allah

Stranded travelers

📌 Zakat cannot be given to parents, children, spouse, or wealthy people.

When Should Zakat Be Paid?

- Once your wealth completes one lunar year

- You may pay in advance

- Delaying without reason is sinful

Zakat on Salary – Is It Required?

Salary itself is not taxed, but:

Saved salary after one year

Amount above Nisab

→ Zakat is compulsory

Conclusion

Zakat is a pillar of Islam, a means of purification, and a powerful system of social welfare. Understanding Nisab, eligible assets, and proper calculation ensures that Zakat is paid correctly and sincerely, fulfilling both religious duty and humanitarian responsibility.

Using a Zakat Calculator helps Muslims calculate accurately and avoid mistakes, ensuring compliance with Islamic principles.

Popular Calculator Tools

- Interest Rate Calculator

- Annuity Calculator

- Annuity Payout Calculator

- ROI Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator