Loan Calculator

$

Years

Months

Annual Schedule

Monthly Schedule

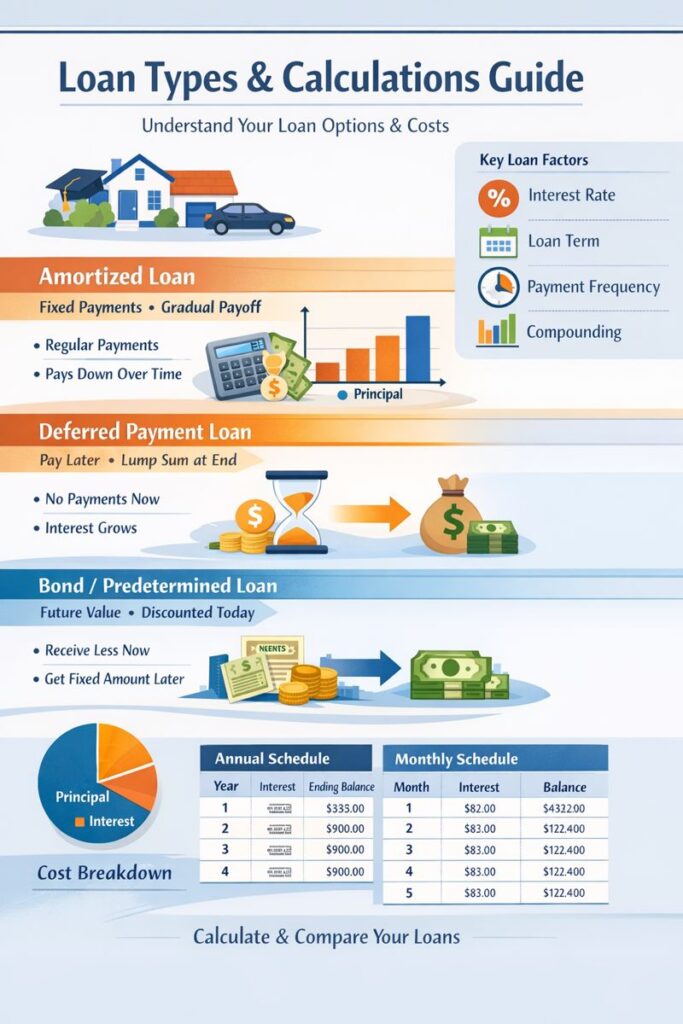

Loan Calculator Guide: Types of Loans, Interest Methods, and How Loan Calculations Work

A Loan Calculator is an essential financial planning tool that helps borrowers estimate their monthly payments, total interest, and overall loan cost before committing to any type of financing. Whether you are purchasing a vehicle, recreational asset, property, or covering personal expenses, understanding repayment obligations in advance allows for smarter decision-making.

With a car loan payment calculator, users can quickly calculate auto loan installments based on interest rate and term, while a boat loan calculator and RV loan calculator help evaluate long-term affordability for leisure purchases. For property buyers, a land loan calculator provides clarity on payment structures that often differ from traditional mortgages. Additionally, a personal loan calculator enables individuals to assess unsecured loans for emergencies, education, or debt consolidation. By entering simple details such as loan amount, interest rate, and duration, this calculator delivers accurate insights, helping users compare options, avoid financial strain, and plan repayments with confidence and financial well-being in mind. This guide explains loan fundamentals, interest calculation methods, and three major loan types—Amortized Loans, Deferred Payment Loans, and Bond (Predetermined Amount) Loans—with clear examples and practical insights.

What Is a Loan?

A loan is a financial agreement where a lender provides money to a borrower, and the borrower agrees to repay the amount over time, usually with interest. Loans are governed by specific terms, including:

- Principal amount

- Interest rate

- Loan duration (term)

- Repayment frequency

- Compounding method

The cost of borrowing depends heavily on how interest is calculated and how frequently payments are made.

Key Loan Terminology Explained

Principal

The principal is the original amount borrowed or invested, excluding interest.

Interest

Interest is the cost of borrowing money, typically expressed as an annual percentage rate (APR).

Loan Term

The loan term is the total duration of the loan, commonly measured in years and months.

Repayment Frequency

This defines how often payments are made:

Monthly

Bi-weekly

Weekly

Quarterly

Annually

Compounding Frequency

Compounding determines how often interest is added to the balance:

Annually

Semiannually

Quarterly

Monthly

Daily

Continuously

How Interest Is Calculated on Loans

Interest calculation depends on both loan type and compounding method.

Simple Interest

Interest is calculated only on the principal.

Common in short-term or informal loans.

Compound Interest

Interest is calculated on the principal plus previously accumulated interest.

Used in most financial institutions, investments, and long-term loans.

Continuous Compounding

Interest is calculated continuously using exponential functions.

Used mainly in theoretical finance and advanced investments.

Types of Loans Explained in Detail

Amortized Loans

An amortized loan is the most common loan type used for:

Home mortgages

Auto loans

Personal loans

Business installment loans

How Amortized Loans Work

Borrowers make fixed periodic payments

Each payment includes:

Interest portion

Principal portion

Over time:

Interest decreases

Principal repayment increases

Key Characteristics

Payments remain constant

Loan balance gradually decreases

Interest is calculated per payment period

Fully paid off by the end of the term

Example

A 10-year loan with monthly payments:

Early payments contain more interest

Later payments focus more on principal

Amortized loans are ideal for borrowers who want predictable payments and gradual debt reduction.

Deferred Payment Loans

A deferred payment loan allows borrowers to postpone payments until the loan reaches maturity.

How Deferred Loans Work

No periodic payments during the loan term

Interest accumulates on the principal

Entire balance is paid at maturity

Key Characteristics

Interest compounds over time

No interim cash outflow

Final payment is significantly higher than the principal

Common Uses

Education loans (during study period)

Short-term business financing

Investment holding strategies

Deferred loans are useful when cash flow is limited initially, but future income is expected.

Bond / Predetermined Amount Loans

A bond loan is structured around a known future value rather than a known initial amount.

How Bond Loans Work?

The borrower repays a fixed amount at maturity

The present value is calculated by discounting future value

Interest accrues over time

Key Characteristics

Used in bonds, treasury notes, and investment instruments

Common in corporate and government financing

Calculations work in reverse compared to deferred loans

Typical Applications

Government bonds

Corporate debt securities

Zero-coupon bonds

Bond loans are essential tools in capital markets and long-term financing strategies.

Annual vs Monthly Loan Schedules

Monthly Loan Schedule

- Displays payment-by-payment breakdown

- Shows how interest and balance change each period

- Most accurate for understanding amortized loans

Annual Loan Schedule

- Summarizes yearly totals

- Aggregates interest and balance changes

- Useful for long-term planning and tax analysis

Factors That Affect Loan Cost

- Interest rate

- Loan duration

- Payment frequency

- Compounding frequency

- Loan type

Advantages of Using a Loan Calculator

- Compare loan options

- Estimate monthly payments

- Understand interest impact

- Plan repayment strategies

- Avoid over-borrowing

Advanced calculators that support multiple loan types provide more accurate financial planning.

Popular Calculator Tools

- Period Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- Interest Rate Calculator

- Annuity Calculator

- Annuity Payout Calculator

- ROI Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator