Interest Rate Calculator

Interest Rate: Complete Guide, Types, Examples, and Factors That Affect Interest Rates

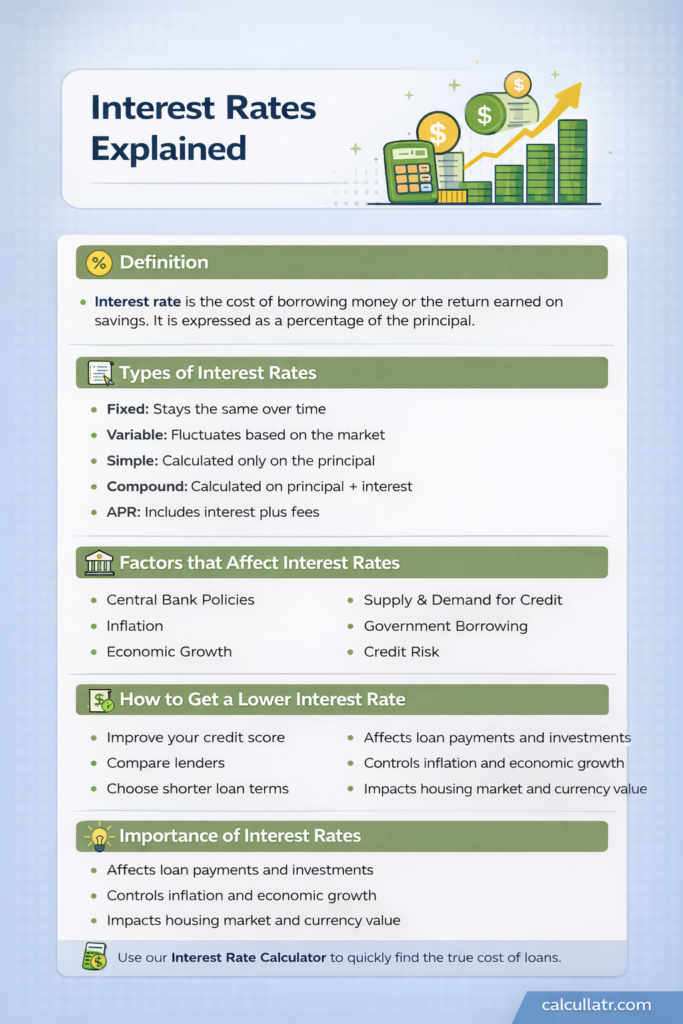

Interest rates play a central role in the global economy. They influence how much it costs to borrow money, how much you earn on savings, and even how fast economies grow. Whether you are taking a loan, investing, running a business, or managing personal finances, understanding interest rates is essential.

This in-depth guide explains what interest rates are, how they work, types of interest rates, factors that affect interest rates, and how to calculate them accurately.

What Is an Interest Rate?

An interest rate is the percentage charged by a lender to a borrower for the use of money, or paid by a bank to a depositor for keeping money in an account. It is usually expressed as an annual percentage.

Simple Definition

Interest rate is the cost of borrowing money or the return earned on savings.

How Interest Rates Work?

When you borrow money:

You repay the principal (original amount)

Plus interest, calculated using the interest rate

When you save or invest:

The bank or institution pays you interest as compensation for using your money.

Interest rates are commonly applied to:

Loans

Credit cards

Mortgages

Savings accounts

Bonds

Investments

About Interest Rate Calculator

An interest rate calculator is a practical financial tool designed to help users accurately estimate interest on loans, investments, and savings. Whether you are planning future deposits or comparing borrowing options, an interest rate calculator for savings allows you to project earnings over time and understand how compounding impacts your final balance. By using an effective interest rate calculator, users can see the true annual cost or return after accounting for compounding frequency, making it easier to compare different financial products. This calculator eliminates manual errors, delivers instant results, and supports smarter financial decision-making for personal finance, banking, and investment planning.

how to calculate interest rate

Simple Interest Formula

Interest = Principal × Rate × Time

Compound Interest Formula

A = P (1 + r/n)^(nt)

Where:

P = Principal

r = Annual interest rate

n = Compounding periods per year

t = Time in years

👉 Use our Interest Rate Calculator to instantly calculate rates without manual formulas.

Types of Interest Rates

Understanding different types of interest rates helps you make better financial decisions.

1. Fixed Interest Rate

A fixed interest rate remains constant throughout the loan term.

Advantages:

Predictable payments

Protection from rising rates

Common Uses:

Fixed-rate mortgages

Personal loans

2. Variable (Floating) Interest Rate

A variable interest rate changes based on market conditions or benchmark rates.

Advantages:

Lower initial rates

Potential savings if rates fall

Risks:

Payments can increase over time

3. Simple Interest Rate

Calculated only on the original principal.

Used in:

Short-term loans

Auto loans

Some personal loans

4. Compound Interest Rate

Calculated on the principal plus accumulated interest.

Used in:

Credit cards

Savings accounts

Investments

Mortgages

5. Nominal Interest Rate

The stated rate before accounting for inflation.

6. Real Interest Rate

Adjusted for inflation.

Real Interest Rate = Nominal Rate − Inflation Rate

This reflects the true purchasing power of money.

7. Annual Percentage Rate (APR)

APR includes:

Interest rate

Fees

Additional loan costs

APR gives a more accurate picture of borrowing cost than the interest rate alone.

Factors That Affect Interest Rates

Interest rates do not exist in isolation. They are influenced by several economic and financial factors.

1. Central Bank Policies

Central banks (e.g., the Federal Reserve in the U.S.) set benchmark interest rates to control inflation and economic growth.

Rate hikes → higher loan costs

Rate cuts → cheaper borrowing

2. Inflation

Higher inflation leads to higher interest rates to preserve purchasing power.

Key Rule:

Rising inflation = rising interest rates

3. Economic Growth

Strong economies increase demand for credit, pushing interest rates upward. Weak economies usually lead to lower rates.

4. Supply and Demand for Credit

High loan demand → higher rates

High savings supply → lower rates

5. Government Borrowing

Large government borrowing increases demand for funds, often raising interest rates.

6. Credit Risk

Borrowers with lower credit scores pay higher interest rates due to increased risk.

7. Loan Term Length

Short-term loans → lower rates

Long-term loans → higher rates

8. Currency Stability

Countries with stable currencies usually enjoy lower interest rates.

Interest Rates in the United States

In the U.S., interest rates are influenced primarily by:

- Federal Reserve policy

- Inflation levels

- Employment data

- Economic growth

- Common U.S. interest-based products:

- Mortgage rates

- Credit card rates

- Student loan rates

- Auto loan rates

Why Interest Rates Matter

Interest rates affect:

- Monthly loan payments

- Investment returns

- Inflation control

- Currency value

- Housing markets

- Consumer spending

Conclusion

Interest rates influence nearly every aspect of personal and global finance. Understanding how interest rates work, the different types, and the factors that affect them helps you make informed borrowing and investment decisions.

Using a reliable Interest Rate Calculator ensures accurate results and saves time, especially when comparing loan options across different countries and currencies.

Popular Calculator Tools

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- Annuity Calculator

- Annuity Payout Calculator

- ROI Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator