Home Equity Line of Credit (HELOC) Calculator

Results

Draw period monthly payment: $0

Repayment period monthly payment: $0

Total of payments: $0

Total interest: $0

Amortization Schedule

The amount of line of credit you can borrow

This tool helps you estimate how much you may be able to borrow through a home equity line of credit by considering your home’s value, remaining mortgage balance, and the lender’s LTV limit.

Result

You may borrow up to: $0

Your current loan-to-value ratio: 0%

Your approved HELOC amount can vary based on several factors, such as your credit standing. Applicants with credit scores under 630 may have difficulty qualifying. Outstanding loans and other debts may also impact how much credit you can receive.

HELOC Calculator: HELOC Meaning, How It Works, and its Pros & Cons

HELOC calculator

Our HELOC calculator helps you accurately estimate your HELOC loan payment and understand how much you can borrow against your home’s equity. Using this HELOC payment calculator, you can instantly calculate monthly interest-only or principal payments based on your credit limit, interest rate, and draw period. This HELOC loan payment calculator is designed for clarity and precision, making it easy to compare scenarios and plan repayments confidently. Whether you’re estimating borrowing power or forecasting costs, our HELOC loan calculator delivers fast, reliable results—completely free. Use our HELOC payment calculator free to make smarter home equity decisions with confidence.

what is Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a flexible borrowing option that allows homeowners to access funds using the equity in their home. Unlike traditional loans that provide a lump sum, a HELOC works more like a credit card, letting you borrow only what you need, when you need it, up to an approved limit.

HELOCs are commonly used for home renovations, debt consolidation, education expenses, medical costs, and other large financial needs.

What Is Home Equity?

Home equity is the portion of your property that you truly own. It is calculated as:

Home Equity = Current Home Value − Outstanding Mortgage Balance

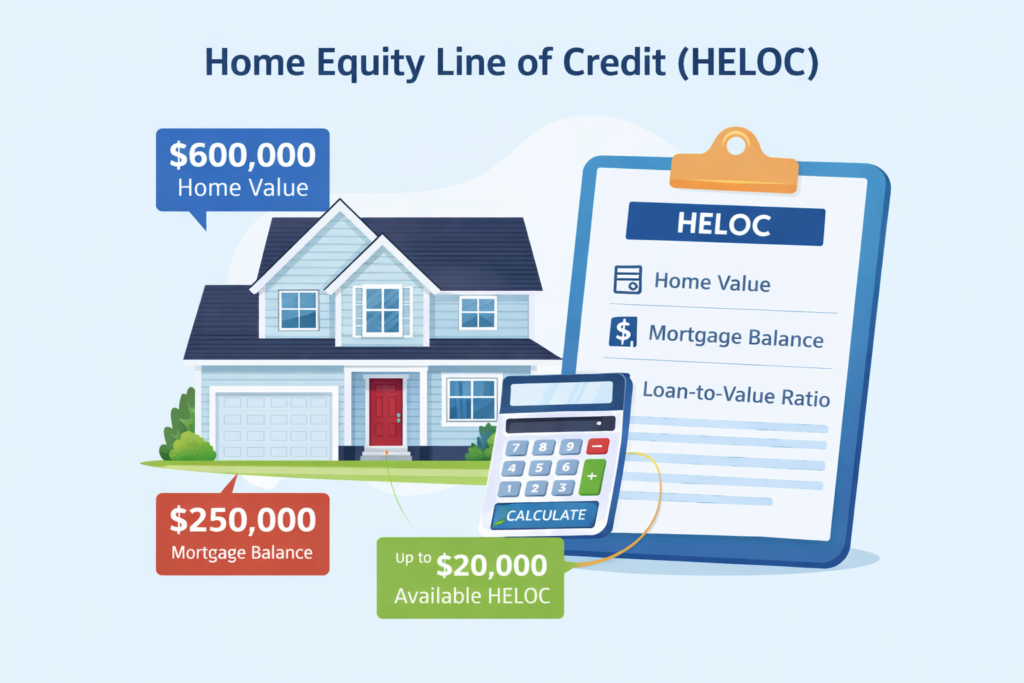

For example, if your home is worth $600,000 and you still owe $250,000 on your mortgage, your home equity is $350,000.

Lenders use this equity to determine how much credit you may qualify for under a HELOC.

How a HELOC Works?

A HELOC typically has two distinct phases:

Draw Period

- Usually lasts 5 to 10 years

- You can borrow funds as needed, up to your credit limit

- Payments are often interest-only

- The loan balance does not reduce unless you pay extra

Repayment Period

- Usually lasts 10 to 20 years

- Borrowing ends

- Monthly payments include principal + interest

- Balance gradually decreases until fully paid off

This structure makes HELOCs more flexible than traditional home equity loans.

How Much Can You Borrow with a HELOC?

The amount you can borrow depends on:

Your home’s current value

Your remaining mortgage balance

The lender’s Loan-to-Value (LTV) ratio

HELOC Calculation Formula

Maximum Loan Allowed = Home Value × LTV Ratio

Available HELOC = Maximum Loan Allowed − Mortgage Balance

Example:

Home Value: $600,000

Mortgage Balance: $250,000

LTV Allowed: 90%

Max Loan Allowed = 600,000 × 0.90 = 540,000

Available HELOC = 540,000 − 250,000 = 290,000

So, you may be able to borrow up to $290,000 through a HELOC.

HELOC Interest Rates Explained

HELOC interest rates are usually:

- Variable, not fixed

- Based on a benchmark rate (such as the prime rate)

- Adjusted periodically

Because rates can change over time, monthly payments during the draw period may increase or decrease depending on market conditions.

Some lenders offer fixed-rate conversion options for part of the balance.

HELOC Monthly Payment Calculation

During Draw Period (Interest-Only)

Monthly Payment = Loan Balance × Monthly Interest Rate

During Repayment Period (Amortized)

Payment = P × r ÷ (1 − (1 + r)^−n)

Where:

P = Loan balance

r = Monthly interest rate

n = Number of months

Using a HELOC calculator is the easiest way to estimate accurate payments and interest costs.

Advantages of a HELOC

- Flexible access to funds

- Interest paid only on the amount used

- Lower interest rates than credit cards

- Potential tax deductibility (subject to tax laws)

- Useful for long-term or unpredictable expenses

Disadvantages of a HELOC

- Variable interest rates can increase costs

- Your home is used as collateral

- Risk of foreclosure if payments are missed

- Can encourage overspending if not managed carefully

HELOC Eligibility Requirements

- Credit score (often 630 or higher)

- Stable income

- Debt-to-income ratio

- Property value and equity

- Payment history

When Is a HELOC a Good Idea?

A HELOC may be suitable if you:

- Have significant home equity

- Need funds over time rather than all at once

- Want lower interest rates than personal loans

- Can manage variable payments responsibly

Should You Use a HELOC Calculator?

Yes. A HELOC calculator helps you:

- Estimate borrowing limits

- Calculate monthly payments

- Compare draw vs repayment costs

- Understand total interest over time

Final Thoughts

A Home Equity Line of Credit can be a powerful financial tool when used wisely. It offers flexibility, competitive interest rates, and convenient access to funds. However, because your home secures the loan, careful planning and accurate calculations are essential.

Before applying, always:

Compare lenders

Review interest rate terms

Use a reliable HELOC calculator

Assess your long-term repayment ability

Popular Calculator Tools

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- Interest Rate Calculator

- Annuity Calculator

- Annuity Payout Calculator

- ROI Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator