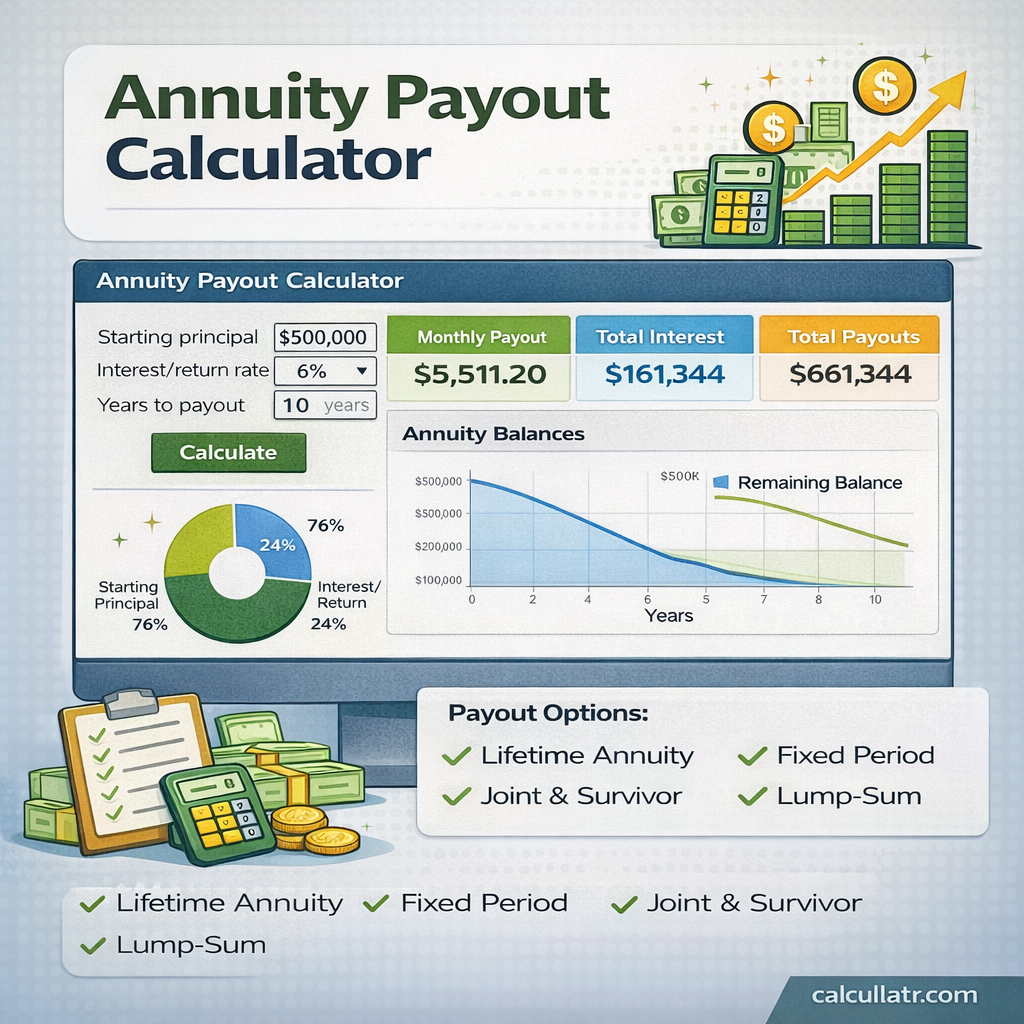

Annuity Payout Calculator

Results

Payout Amount

–

–

Total Interest

–

–

Total Payouts

–

–

Annuity Balances

| Year | Beginning Balance | Interest | Ending Balance |

|---|

Annuity Payout Calculator: How Annuity Payments Work, Payout Options, and Tax Treatment Explained

An annuity payout calculator helps estimate how much income you can receive from an annuity during retirement. Whether you’re planning guaranteed lifetime income or fixed withdrawals over a set period, understanding annuity payouts is essential for effective retirement planning.

This guide explains how annuity payouts work, qualified vs non-qualified annuities, annuity phases, payout options, tax implications, and how to use an annuity payout calculator accurately.

What Is an Annuity Payout?

An annuity payout is the stream of income you receive from an annuity contract after the accumulation phase ends. During this phase, the insurance company converts your annuity balance into regular payments based on factors such as:

- Account value

- Interest or return rate

- Payout duration

- Payout frequency (monthly, quarterly, yearly)

- Life expectancy (for lifetime payouts)

An annuity payout calculator estimates this income so you can plan your retirement more confidently

How an Annuity Payout Calculator Works

An annuity payout calculator determines your periodic withdrawal amount using:

Starting principal (annuity value)

Interest or return rate

Payout period

Payment frequency

The calculator applies financial formulas similar to loan amortization but in reverse—gradually reducing your balance while factoring in earned interest.

Key Benefits of Using an Annuity Payout Calculator

- Estimates monthly or yearly retirement income

- Compares different payout options

- Helps avoid running out of money

- Supports long-term financial planning

Phases of an Annuity

Annuities have two main phases, and understanding them is crucial before selecting payout options.

Accumulation Phase

The accumulation phase is when you fund the annuity. During this period:

- You make lump-sum or periodic contributions

- Your money grows tax-deferred

- Interest or market returns accumulate

This phase may last several years or decades

Payout (Annuitization) Phase

The payout phase begins when you start receiving income from the annuity. At this stage:

- Contributions stop

- Regular withdrawals begin

- Your balance declines over time (unless indexed or variable)

An annuity payout calculator is used only during this phase.

Qualified vs Non-Qualified Annuities

One of the most searched annuity topics is the difference between qualified and non-qualified annuities, especially for tax planning.

Qualified Annuities

Qualified annuities are funded using pre-tax dollars from tax-advantaged retirement accounts such as:

401(k)

403(b)

Traditional IRA

Tax Treatment

Entire payout is taxable as ordinary income

Subject to Required Minimum Distributions (RMDs) after age 73 (USA)

Best For

Employer-sponsored retirement plans

Individuals seeking tax-deferred retirement growth

Non-Qualified Annuities

Non-qualified annuities are funded using after-tax dollars.

Tax Treatment

Only the earnings portion of payouts is taxable

Principal is returned tax-free

Not subject to RMD rules

Best For

Individuals who have maxed out retirement accounts

Supplemental retirement income

Annuity Payout Options Explained

Choosing the right payout option is critical, as many annuity decisions are irrevocable.

1. Lifetime Annuity (Life-Only)

Pays income for as long as you live.

Pros

Guaranteed lifetime income

No longevity risk

Cons

Payments stop at death

No inheritance

2. Life with Period Certain

Pays income for life, but guarantees payments for a minimum period (e.g., 10 or 20 years).

Pros

Protects beneficiaries

Lifetime security

Cons

Slightly lower payments than life-only

3. Fixed Period Annuity

Pays income for a specific number of years.

Pros

Predictable income

Higher periodic payouts

Cons

Risk of outliving the income stream

4. Joint and Survivor Annuity

Covers two individuals, usually spouses.

Pros

Income continues for surviving spouse

Cons

Lower payout amounts

5. Lump-Sum Payout

Withdraws the entire balance at once.

Pros

Full liquidity

Investment flexibility

Cons

Large tax burden

Loss of guaranteed income

Annuity Payout Frequency Options

Most annuity payout calculators allow you to choose payout frequency:

Monthly (most common)

Quarterly

Semi-annually

Annually

More frequent payouts typically result in slightly lower per-payment amounts.

Taxation of Annuity Payouts

Ordinary Income Tax

Earnings are taxed as regular income

No capital gains rates apply

Early Withdrawal Penalty

Withdrawals before age 59½ may incur a 10% IRS penalty (USA)

Exclusion Ratio (Non-Qualified Annuities)

Determines how much of each payment is taxable vs tax-free.

Factors That Affect Annuity Payout Amounts

- Age at annuitization

- Interest rate environment

- Account balance

- Payout duration

- Inflation protection

- Fees and riders

Fixed vs Variable vs Indexed Annuity Payouts

Fixed Annuity Payouts

Guaranteed payments

Predictable income

Variable Annuity Payouts

Payments fluctuate with market performance

Higher risk, higher potential return

Indexed Annuity Payouts

Linked to market indexes

Downside protection with capped growth

Why Use an Online Annuity Payout Calculator?

Using an online annuity payout calculator helps you:

Compare payout strategies

Plan retirement income streams

Avoid costly annuity mistakes

Make data-driven decisions

It eliminates guesswork and shows clear financial projections.

- Choosing irreversible payout options too early

- Ignoring inflation

- Underestimating taxes

- Not comparing payout structures

- Failing to include beneficiaries

Final Thoughts

An annuity payout calculator is one of the most powerful retirement planning tools available. By understanding qualified vs non-qualified annuities, annuity phases, and payout options, you can maximize income while minimizing risk.

Before selecting an annuity payout structure, use a calculator, evaluate tax implications, and consider long-term retirement goals.

Popular Calculator Tools

- Interest Rate Calculator

- Annuity Calculator

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- ROI Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator