Return on Investment (ROI) Calculator

Result

Return on Investment (ROI): Meaning, Formula, ROI Calculator, Examples, and How to Use ROI Effectively

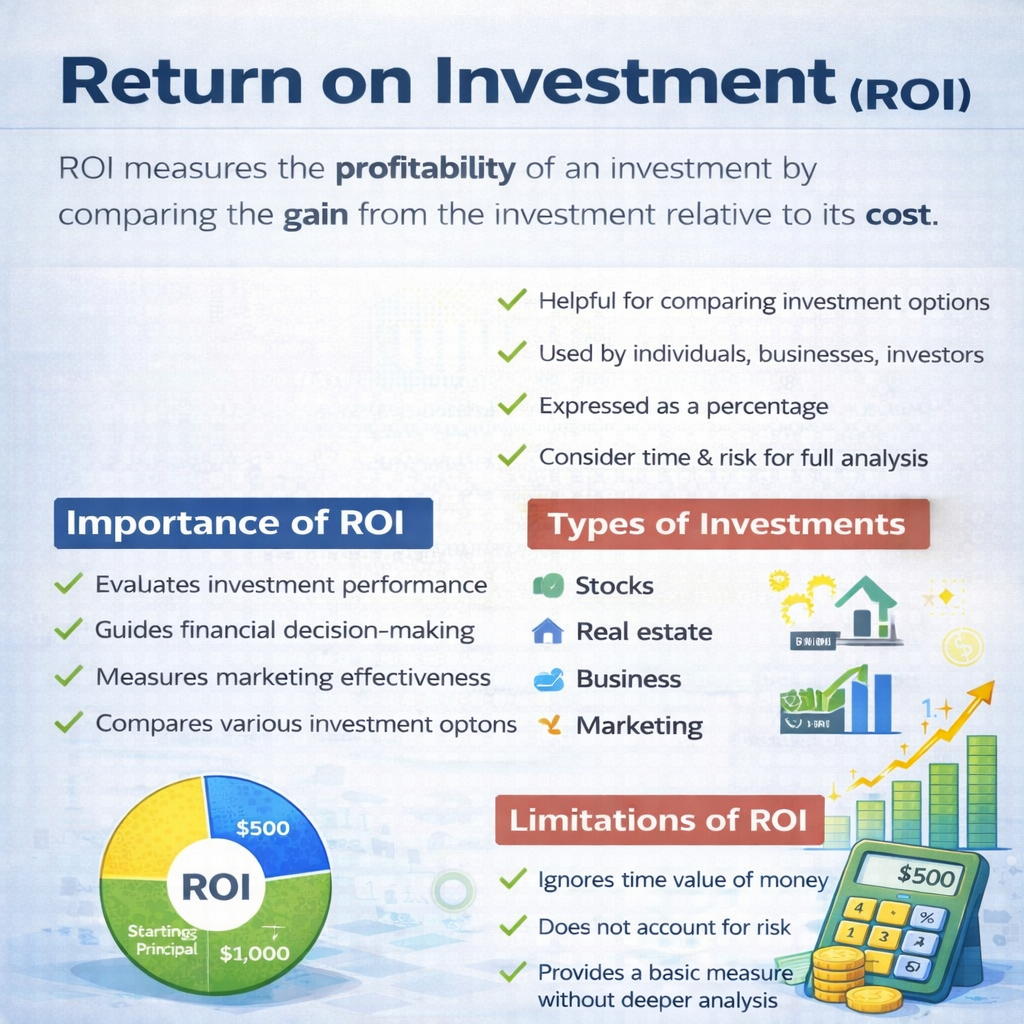

Return on Investment (ROI) is one of the most widely used financial metrics in the world. It helps investors, businesses, and individuals measure how profitable an investment is compared to its cost. Whether you are evaluating stocks, real estate, a business project, marketing campaign, or even education expenses, ROI provides a simple and standardized way to compare returns across different investments.

Because of its simplicity and clarity, ROI is frequently searched by people looking to understand investment performance, profitability, and financial decision-making.

What Is Return on Investment (ROI)?

Return on Investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment. It shows how much profit or loss an investment has generated relative to the amount of money invested.

ROI is expressed as a percentage, making it easy to compare investments of different sizes. A higher ROI indicates a more profitable investment, while a negative ROI means the investment resulted in a loss.

ROI is commonly used by:

- Individual investors

- Business owners and entrepreneurs

- Financial analysts

- Marketing teams

- Real estate investors

ROI Formula

The basic formula for calculating Return on Investment is:

ROI = (Gain from Investment − Cost of Investment) ÷ Cost of Investment × 100

Where:

Gain from Investment is the final value or amount returned

Cost of Investment is the initial amount invested

This formula focuses purely on profitability and does not consider risk or time unless additional calculations are applied.

Calculating ROI with Example

Suppose you invest $1,000 in a project. After some time, the investment grows and you receive $1,500.

Cost of Investment = $1,000

Gain from Investment = $1,500

Net Gain = $1,500 − $1,000 = $500

Now apply the ROI formula:

ROI = ($500 ÷ $1,000) × 100

ROI = 50%

This means the investment earned a 50% return on the original amount invested.

Annualized ROI (ROI Over Time)

Standard ROI does not account for how long the investment was held. This can be misleading when comparing investments of different durations. To solve this, Annualized ROI (also called Compound Annual Growth Rate) is used.

Annualized ROI Formula

Annualized ROI = [(Final Value ÷ Initial Value)^(1 ÷ Number of Years) − 1] × 100

Example of Annualized ROI

If you invested $1,000 and it grew to $2,000 over 4 years:

Annualized ROI = [(2000 ÷ 1000)^(1 ÷ 4) − 1] × 100

Annualized ROI ≈ 18.77% per year

This shows the average yearly return rather than the total return.

Why ROI Is Important

ROI is important because it helps decision-makers evaluate whether an investment is worth pursuing. Businesses use ROI to compare marketing campaigns, equipment purchases, or expansion plans. Investors use it to analyze stocks, mutual funds, or real estate. Individuals may use ROI to assess education costs, side businesses, or long-term savings plans.

Because ROI is standardized, it allows fair comparison between different investment opportunities.

ROI in Different Types of Investments

ROI can be applied across many financial areas. In stock market investing, ROI measures gains from share price appreciation and dividends. In real estate, ROI includes rental income, property appreciation, and expenses. In business, ROI evaluates profits relative to operational or capital costs. In marketing, ROI measures revenue generated from advertising campaigns compared to marketing spend.

Despite different applications, the underlying principle remains the same: measuring profitability relative to cost.

Comparison Table: ROI by Investment Type

| Investment Type | Average ROI | Risk Level |

|---|---|---|

| Stocks | 8%–12% | Medium–High |

| Real Estate | 6%–15% | Medium |

| Mutual Funds | 8%–15% | Medium |

| Fixed Deposits | 4%–7% | Low |

| Cryptocurrency | Highly Variable | Very High |

| Business/Startup | 15%–100%+ | Very High |

| Bonds | 3%–8% | Low–Medium |

| Gold | 6%–10% | Medium |

Limitations of ROI

Although ROI is extremely useful, it has some limitations. It does not account for time value of money, unless annualized. It ignores risk, meaning two investments with the same ROI may have very different risk levels. ROI also does not include cash flow timing, which can be important for long-term projects.

For complex financial analysis, ROI is often used alongside other metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period.

ROI vs Rate of Return

People often confuse ROI with rate of return because the terms sound similar, but they do not mean the same thing. ROI measures the total profitability of an investment over its entire holding period. In contrast, rate of return measures performance over a specific time period, usually on an annual basis. ROI offers a simpler way to evaluate overall profitability, while rate of return delivers more detailed insight by showing how returns change over time.

How an Return On Investment ROI Calculator Helps?

An ROI calculator simplifies the entire process by automatically computing:

Investment gain

ROI percentage

Annualized ROI

Investment duration

Modern ROI calculators also allow users to select countries and currencies, input investment duration using dates or years and months, and visualize results through charts and graphs. This makes ROI calculations more accurate, faster, and user-friendly.

Conclusion

Return on Investment (ROI) is a powerful and essential financial metric that helps measure investment profitability across nearly every industry. By understanding the ROI formula, calculation methods, and limitations, investors and businesses can make more informed financial decisions.

Whether you are planning a new investment, analyzing past performance, or comparing multiple opportunities, ROI provides a clear starting point for evaluating financial success.

Popular Calculator Tools

- Interest Rate Calculator

- Annuity Calculator

- Annuity Payout Calculator

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- Sales Tax Calculator

- VAT Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator