VAT Calculator

Value Added Tax (VAT): Complete Guide, VAT Calculator, Examples & VAT vs Sales Tax

What Is VAT (Value Added Tax)?

Value Added Tax (VAT) is a consumption tax applied to goods and services at every stage of the supply chain where value is added. Unlike income tax, VAT is paid by the final consumer, although it is collected and remitted to the government by businesses.

VAT is widely used across the world and is the primary tax system in over 160 countries. These countries include the United Kingdom, European Union nations, Canada (GST/HST), Australia, and many Asian and African countries.

How VAT Works

VAT is charged at each step of production and distribution, but businesses can reclaim VAT they have already paid on inputs. This ensures that tax is only applied to the value added at each stage.

Example:

Manufacturer sells product → charges VAT

Wholesaler resells product → charges VAT, claims previous VAT

Retailer sells to consumer → charges VAT, claims previous VAT

Consumer pays the final VAT amount

The government ultimately receives VAT only from the final consumer.

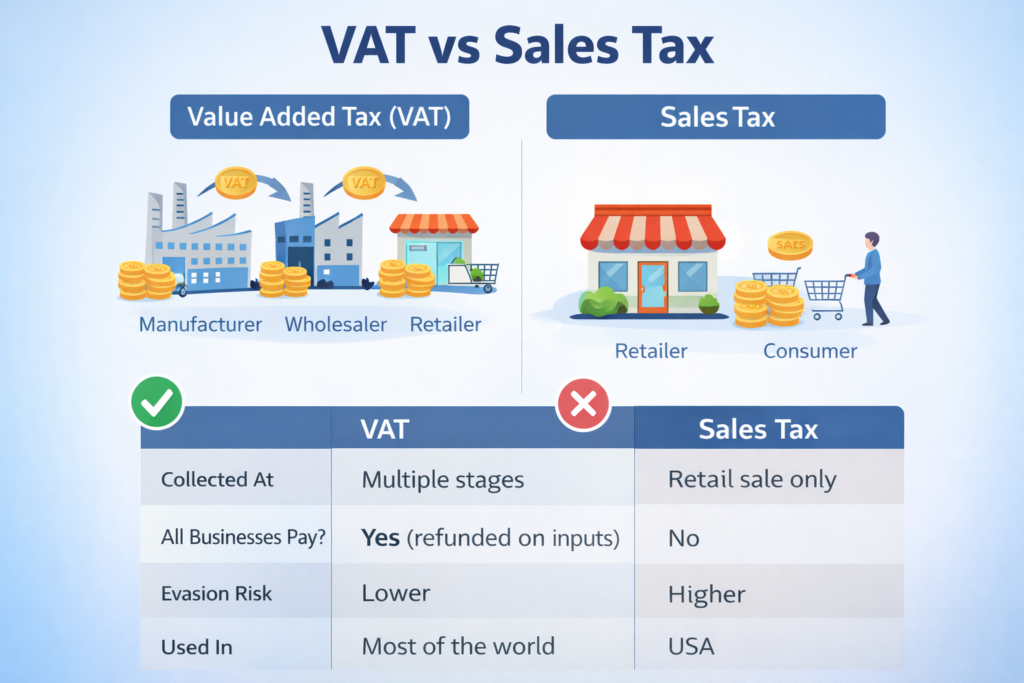

VAT vs Sales Tax (Key Differences)

Why VAT Is Considered Better

- Reduces tax evasion

- Fairer collection system

- Transparent pricing

- Stable government revenue

VAT Rates Explained

VAT rates vary by country and product category.

Common VAT Rate Types:

Standard Rate – Applied to most goods/services

Reduced Rate – Essentials like food or medicine

Zero Rate – Exports, basic necessities

Exempt – Financial services, education, healthcare

Example VAT Rates:

UK: 20%

Germany: 19%

France: 20%

Pakistan: 18%

UAE: 5%

How is VAT Calculated Using vat calculator

VAT can be calculated in two main ways depending on whether VAT is included or excluded.

1️⃣ VAT Calculation When Net Price Is Known

Formula:

VAT Amount = Net Price × VAT Rate Gross Price = Net Price + VAT Amount

Example:

Net Price = 1200

VAT Rate = 20%

VAT = 1200 × 0.20 = 240

Gross Price = 1200 + 240 = 1440

2️⃣ VAT Calculation When Gross Price Is Known

Formula:

Net Price = Gross Price ÷ (1 + VAT Rate) VAT Amount = Gross Price − Net Price

Example:

Gross Price = 1440

VAT Rate = 20%

Net = 1440 ÷ 1.20 = 1200

VAT = 1440 − 1200 = 240

VAT Registration Explained

Businesses must register for VAT once they exceed a country’s VAT threshold.

Example Thresholds:

UK: £85,000 annual turnover

EU: Varies by country

Pakistan: Mandatory for registered businesses.

Registered businesses must:

Charge VAT

File VAT returns

Keep VAT invoices

Pay VAT periodically.

VAT Refunds and Claims

VAT refunds apply to:

Export businesses

Tourists (in some countries)

Businesses with excess input VAT

Refund claims must be supported by valid invoices and records.

Advantages of VAT

✔ Reduces tax evasion

✔ Stable revenue source

✔ Fair distribution of tax burden

✔ Encourages proper accounting

✔ Transparent tax system

Disadvantages of VAT

❌ Can increase consumer prices

❌ Compliance burden for small businesses

❌ Requires strong tax administration

Why Use an Online VAT Calculator?

A VAT calculator helps you:

Instantly calculate VAT

Avoid manual errors

Convert net ↔ gross prices

Save time for businesses and individuals.

It is especially useful for invoices, accounting, freelancing, e-commerce, and cross-border trade.

Final Thoughts

VAT is one of the most important taxes worldwide, impacting consumers, businesses, and governments alike. Understanding how VAT works, how it differs from sales tax, and how to calculate it correctly helps ensure compliance and accurate pricing.

Using a VAT calculator simplifies calculations, prevents mistakes, and saves valuable time.

Popular Calculator Tools

- Interest Rate Calculator

- Annuity Calculator

- Annuity Payout Calculator

- ROI Calculator

- Sales Tax Calculator

- Period Calculator

- Loan Calculator

- Ovulation Calculator

- Home Equity Line of Credit (HELOC) Calculator

- Blood Pressure Calculator

- Pregnancy Calculator

- Conception Calculator

- Due Date Calculator

- Pregnancy Weight Gain Calculator

- Pregnancy Conception Calculator

- Total Daily Energy Expenditure (TDEE) Calculator

- Fat Intake Calculator

- BMI Calculator

- Calorie Calculator

- Body Fat Calculator

- BMR Calculator

- Ideal Weight Calculator

- Lean Body Mass Calculator

- Percentage Calculator

- Area Calculator

- GPA Calculator

- CGPA Calculator

- Age Calculator

- Zakat Calculator